Attaining monetary wellness doesn’t should be a frightening process. By implementing sensible saving methods and making aware selections about your spending habits, you possibly can work in direction of a more healthy monetary future whereas decreasing stress alongside the best way. Listed here are some suggestions for saving cash and decreasing stress:

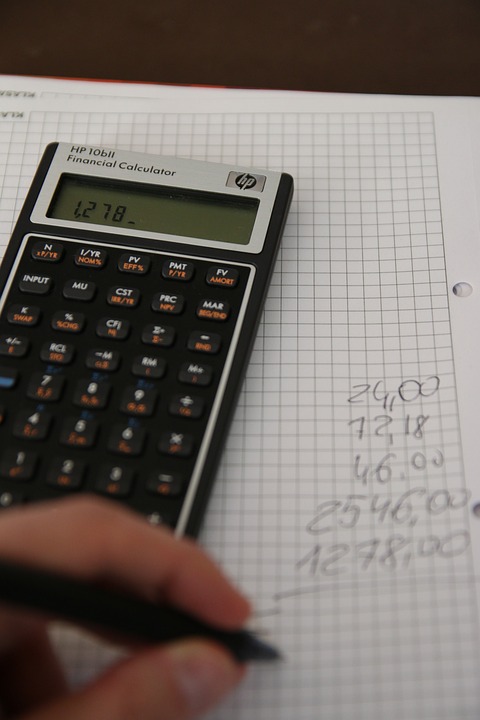

1. Create a funds: Step one in enhancing your monetary wellness is to create a funds that outlines your revenue and bills. It will make it easier to establish areas the place you possibly can in the reduction of on spending and allocate extra money in direction of financial savings. Be sincere with your self about your monetary targets and priorities, and follow your funds as intently as attainable.

2. Automate your financial savings: One of many best methods to economize is to arrange automated transfers out of your checking account to your financial savings account. By automating your financial savings, you possibly can make sure that you constantly save a portion of your revenue every month with out having to consider it. This might help you construct up your financial savings over time and cut back monetary stress.

3. Reduce on pointless bills: Take a tough take a look at your spending habits and establish areas the place you possibly can in the reduction of. This may imply consuming out much less regularly, canceling subscriptions you don’t use, or discovering cheaper alternate options for on a regular basis bills. By decreasing pointless prices, you possibly can liberate extra money to place in direction of financial savings or paying off debt.

4. Plan for the sudden: One of many largest sources of monetary stress is sudden bills, similar to automotive repairs or medical payments. To cut back the influence of those sudden prices, contemplate organising an emergency fund that may cowl three to 6 months’ price of dwelling bills. Having an emergency fund in place can offer you peace of thoughts and make it easier to keep away from going into debt when confronted with sudden monetary challenges.

5. Prioritize your monetary targets: Establish your short-term and long-term monetary targets, similar to saving for a trip, paying off debt, or shopping for a house. By prioritizing your monetary targets and making a plan to realize them, you possibly can keep motivated and on monitor in direction of reaching monetary wellness.

Attaining monetary wellness is a journey that requires self-discipline, dedication, and endurance. By implementing the following tips for saving cash and decreasing stress, you possibly can take management of your funds and work in direction of a brighter monetary future. Keep in mind that small adjustments can add as much as huge financial savings over time, so begin making optimistic adjustments in the present day for a more healthy monetary tomorrow.