Might you pay your mortgage, groceries, hire, insurance coverage, medical bills, and different payments on $2000/month? In case you might, what sort of life-style may you lead?

Hundreds of thousands of retirees throughout America stay it day by day.

The Social Safety Administration stories that fifty% of aged married beneficiaries and 70% of singles depend on Social Safety for greater than half of their month-to-month revenue. Contemplating that the common Social Safety verify is round $1361/month, it is a actually powerful place to be in for therefore many of those retirees.

And I’ve met them. Lots of them.

Yearly at my insurance coverage company, we meet 1000’s of child boomers ageing into Medicare at 65. We frequently see their shock, dismay, and confusion after they notice that the price of their healthcare in retirement will simply eat up at the very least 20% to 30% of that Social Safety verify each month.

Irrespective of the way you slice it, even the very best of the retiree budgeters on the market are more likely to have bother making ends meet on Social Safety revenue alone.

Generally relating to private finance, budgeting isn’t the issue.

Generally revenue is the issue.

Luckily, there’s excellent news on that entrance, as a result of we stay in an age the place there are extra alternatives to earn extra cash than ever earlier than. Our digital world has made this attainable, and it couldn’t have come at a greater time.

Whenever you’re on a set revenue and struggling to make ends meet, a aspect hustle that pays you even a couple of hundred {dollars} a month generally is a great assist.

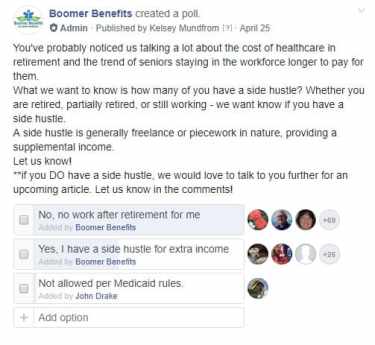

At Boomer Advantages, we polled our Fb followers – largely child boomers and seniors – to ask what sort of side-hustles they’re rocking on the market in the actual world. What we discovered is that there’s a wide selection of the way through which inventive retirees are supplementing their Social Safety revenue.

Right this moment, I’ll share a couple of of their tales to present you some concepts in your personal attainable side-hustle that would doubtlessly assist to scale back monetary fear and afford you a greater life-style in retirement.

Educate From House

Do you know which you could receives a commission to show English with out leaving your own home? That’s proper, and it is a good instance of a retirement aspect hustle that exists at present that will not have been attainable ten years in the past.

Valerie Heidel shared with us that she makes use of an internet educating platform referred to as Cambly to show English to college students in Saudi Arabia, China, Japan, and even Brazil. She discovered this job alternative by looking on-line for earn a living from home part-time jobs. This work-from-home half was a should in order that she might make her personal schedule and work solely when she feels prefer it.

What was additionally essential to Valerie to find a aspect hustle was the sense of function and productiveness. And, as a result of she has fairly a couple of repeat weekly college students, the job provides her spending money. She earns $0.17 per minute that she is on-line with a pupil, which comes out to $10.20/hour.

Not dangerous for a job that doesn’t require her to go away her home. And this part-time gig doesn’t require a level both. You could be permitted for educating gigs like this one in as little as two days (though for some candidates it may take as much as two months).

One other retiree we spoke with shared how she used her part-time educating revenue to transition into retirement. Our consumer Nancy was educating full-time at one faculty whereas additionally educating well being programs part-time on-line as an adjunct teacher. When she was laid off from her full-time job unexpectedly, she was in a position to transition into semi-retirement by retaining the part-time well being educating.

J.D.’s word: When Kim’s father retired from educating high-school English, he too picked up some further money by educating college-level English lessons on-line.

Nancy shared that she has a bodily incapacity which might make it troublesome for her to show in a classroom or report back to an workplace for work. The power to show proper from her laptop computer by the college’s Studying Administration System has even allowed her to work when she was hospitalized. As soon as the programs are created, her principal duties are to reply to emails and grade assignments.

She loves that it retains her lively and says that she can be bored with out this job, so she plans to proceed educating for so long as she probably can.

Nancy shared that she and her partner at the moment use her part-time revenue to complement their Social Safety revenue advantages in order that they’ll keep away from dipping into their retirement financial savings for so long as attainable.

Takeaway: Almost everybody has a ability that they may flip right into a tutoring, educating or mentorship place. Along with Cambly, you possibly can verify for alternatives that suit your expertise at websites like Tutor, Skooli, and Yup.

Flip Your Ardour into Half-Time Earnings

Jeanine Handley has been a inventive artist all her life and labored in graphic design. Now that she’s retired, she does distant graphic design work for purchasers out of her own residence.

Jeanine Handley has been a inventive artist all her life and labored in graphic design. Now that she’s retired, she does distant graphic design work for purchasers out of her own residence.

She’s additionally managed to show this ardour right into a enterprise proper in her personal neighborhood. A number of years in the past, when she relocated to Florida, she moved right into a 55+ neighborhood. Lots of the residents there are lively seniors who need to be taught and discover new issues in their very own retirement.

Jeanine observed that many residents didn’t know how one can use the digicam and modifying options on their smartphones. She helped one girl in her eighties with choosing out a brand new smartphone and iPad and started weekly classes to indicate her how one can use each.

This blossomed right into a course there in the neighborhood through which Jeanine helps to introduce other people to smartphones and smartphone images. She will talk and train these expertise in a way that different seniors perceive and recognize.

Jeanine prices a small payment for this and the cash she earns helps to complement her revenue and be capable of afford among the further issues like journey, leisure, and eating out.

As an artist at coronary heart, she doesn’t plan to ever retire this aspect hustle. Take into consideration your personal hobbies and passions. Might there be a manner so that you can flip that into an income-producing aspect gig?

One other side-hustler who plans to by no means retire is our consumer Billy who’s an expert Santa Claus.

That’s proper. Santa Claus! How cool is that for an revenue booster?

As a member of three skilled Santa Claus organizations, Billy seems in every single place from faculties and eating places to massive metropolis occasions to unfold the vacation cheer. He stresses that this side-hustle is one that actually comes out of your coronary heart and never from the boots and swimsuit that you simply put on.

He enjoys speaking to kids of all ages and listening to their wants. Generally the job can require emotional fortitude because the requests aren’t all the time about presents or toys however typically could embody a plea that Santa helps a toddler’s father discover a job.

But even so, Billy admits that what he enjoys most is visiting houses of youngsters who’re both chronically unwell or home-bound. These visits fulfill his coronary heart whereas the aspect revenue he earns helps he and his spouse to pay a few of their bills in retirement.

Being Santa generally is a severe enterprise each emotionally and professionally. Billy should cross a legal background verify every year and has repeatedly attended faculties and seminars to good his craft. He’s additionally a member of three skilled Santa Claus organizations.

Takeaway: Take into consideration the issues in your life that you simply completely like to do. Might your ardour profit another person? How might you monetize that so to earn some revenue whereas performing actions that hardly really feel like work in any respect?

Change into a Contractor for Your Former Employer

When Roberta Baciak retired from working in a neighborhood faculty lunchroom, she felt so dangerous about leaving them that she volunteered to be a fill-in employee at any time when they’re short-staffed. They had been fast to take her up on her supply, so now she works sooner or later per week each week and typically will get referred to as in on different days.

She additionally works from residence 15 hours per week as an administrative help for a espresso store and roasting firm owned by her daughter and son-in-law. She takes care of their invoices, payroll, getting into bills into Quickbooks, sending statements and issues like that.

Her aspect hustles have afforded her the flexibility to repay some medical payments and to have some pocket money to spend on little issues her grandsons. She additionally loves the respect of serving to her household with their rising enterprise.

She plans on working so long as she will for her household and doubtless one other 12 months or so on the faculty lunchroom as a result of she enjoys seeing her co-workers and the youngsters in school.

Roberta recommends that different retirees in search of side-income verify with their native faculties as a result of lunchrooms are sometimes in search of people who find themselves prepared to fill-in on an on-call foundation.

Takeaway: Contemplate negotiating part-time employment together with your final employer earlier than retirement. You by no means know after they may agree! If that’s not an possibility, who are you aware that has a enterprise? Are there any part-time companies that you might supply to them together with your expertise?

Get Financially Match with Furballs

I truthfully can’t consider a aspect gig I might take pleasure in greater than getting paid to hang around with some fur youngsters. Busy working professionals are utilizing pet sitting companies greater than ever – J.D. tells me he continuously makes use of Rover to e book walks for his canine — and what’s nice about this explicit job is that you might work contract although a pet sitting service, or you might simply put up your companies in neighborhood websites like Nextdoor.

I truthfully can’t consider a aspect gig I might take pleasure in greater than getting paid to hang around with some fur youngsters. Busy working professionals are utilizing pet sitting companies greater than ever – J.D. tells me he continuously makes use of Rover to e book walks for his canine — and what’s nice about this explicit job is that you might work contract although a pet sitting service, or you might simply put up your companies in neighborhood websites like Nextdoor.

This aspect hustle is actually versatile as a result of you possibly can work solely once you need to, and you may pet website in your personal residence or in another person’s residence for a bit of more money.

I personally am a busy entrepreneur, working lengthy hours on the workplace and continuously touring for enterprise. After I’m going to be gone in a single day, I pay a pal’s mother, who’s retired, to come back and spend the evening with my fur infants.

It helps me sleep at evening to know that somebody is caring for them, however I additionally know love that my pet sitter is a retiree who can actually use the cash to assist her make ends meet. It’s a win-win for everybody.

Unsure about overnights? You may begin with some day visits or dog-walking, each of that are different pet companies that many working folks willingly pay for.

Takeaway: This one is probably the simplest aspect gig of all to get began in. Submit in your favourite neighborhood app or enroll as a pet sitter or canine walker with websites stay Rover or Wag.

What Will Your Subsequent Aspect Hustle Be?

These are only a few of the enjoyable and inventive methods to earn further retirement revenue that a few of our personal social media followers at Boomer Advantages have shared with us. It doesn’t matter what sort of labor you used to do, there are infinite alternatives for brand new issues that you are able to do as soon as you might be retired to complement your revenue from Social Safety and investments.

If educating or pet sitting aren’t your factor, take a look at our put up on 50 Ingenius Methods to Earn Cash in Retirement for added inspiration. You may additionally take a look at Ryan Helms’ Hustle to Freedom podcast, which is one which I’ve referred dozens of individuals to after they’ve shared that they need to work part-time however aren’t fairly positive doing what.

The secret is understanding that our digital world actually does make it simpler than ever to place a couple of further {dollars} in your pocket every month and typically simply that little bit makes all of the distinction.

Blissful Hustling!