Indian Abroad Financial institution, also referred to as IOB, is likely one of the main banks in India providing on-line banking companies to prospects. The IOB web banking permits prospects to carry out numerous banking actions from their cell or laptop with out visiting the financial institution. Buyer can handle their account, pay payments, and switch funds from the IOB web banking.

Right here, we are going to clarify the small print of IOB web banking, registration, login, and its options. IOB web banking company login, and so on.

Additionally learn: Union Financial institution of India Web banking: Registration, Login Course of

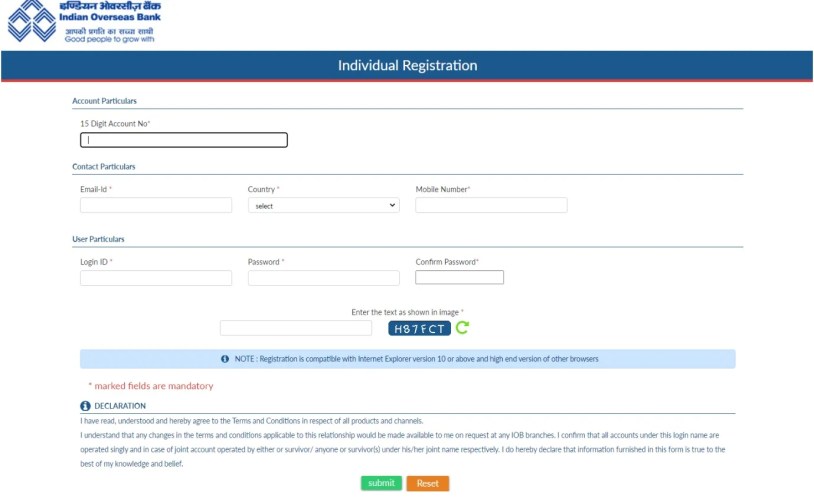

Learn how to Register for IOB Web Banking?

The IOB web banking registration is easy and may be performed by following the steps talked about under:

- Enter particulars similar to account quantity, registered cell quantity, and DOB.

- Set login passwords and transaction passwords in response to tips.

- Enter the OTP.

- Your registration is profitable; now you need to use the online banking account utilizing your ID and password.

- Be certain that to vary your login and transaction password usually to make sure protected transactions.

Learn how to Register for IOB Web Banking through Telephone Banking?

It’s also possible to do IOB web banking registration through cellphone banking. The steps are talked about under:

- Name 18004254445 to get solutions to your queries.

- Present your buyer ID quantity or phone ID Quantity, or confirm your checking account quantity.

- The client govt will contemplate your request for IOB web banking registration.

- You’ll obtain a web banking password to your tackle by postal companies.

Learn how to Register for IOB Web Banking at a Financial institution Department?

It’s also possible to go to the IOB department to get IOB web banking registration. Comply with the steps under:

- Go to your IOB department and ask the manager for the paperwork for IOB web banking registration.

- Fill out the shape fastidiously and provides it to the manager.

- You’ll obtain an SMS containing the consumer ID and Password for IOB login on the registered cell quantity.

- Additionally, you will obtain the Login ID and password particulars at your tackle through put up inside 10 days after you apply on the department.

- Your account is prepared for IOB web banking login.

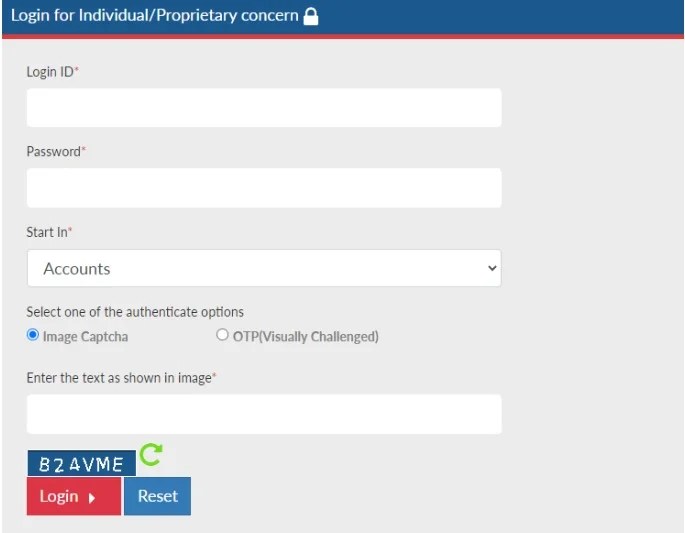

IOB Web Banking Login Course of

The consumer can log in IOB banking account utilizing the steps under:

- Go to the official IOB e-banking web sitehttps://www.IOBnet.co.in/

- Choose ‘Private Banking’

- Now, choose ‘Web banking Login’.

- Enter your consumer ID appropriately within the house supplied.

- Enter your IOB web banking login password and safety questions.

- Reply the safety query fastidiously.

- Now, you have got efficiently logged into the IOB web baking portal. You possibly can benefit from the companies.

- Please search the IOB buyer companies when you face any points.

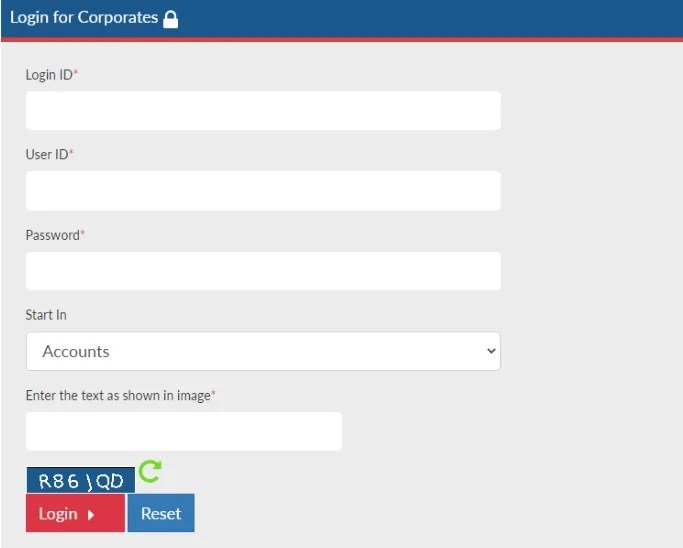

IOB Web Banking Company Login

For those who want to arrange an account for IOB Web Banking company, it’s easy. Comply with the steps under:

- GO to IOB netbanking official web site.

- Click on on “Log in.”

- Select “Web banking Company login.”

- Enter your Login ID, password, and Captcha textual content.

- Click on “Login”. Your IOB web banking company account is able to use.

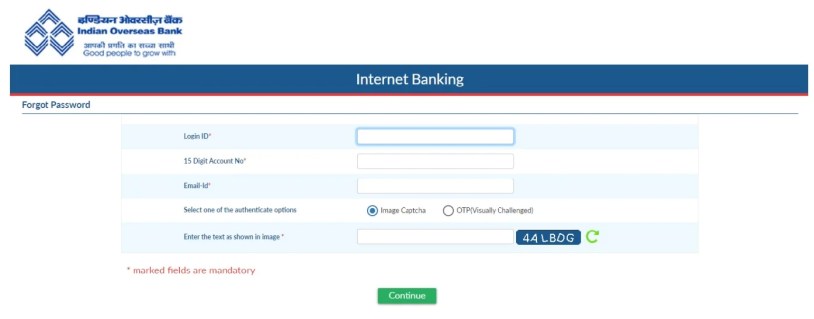

Learn how to Reset the IOB Web Banking Password?

It’s simple to reset the online banking password. Comply with the steps talked about right here:

- Open the Indian Abroad Financial institution’s official web site.

- Click on on “Private banking” or “Company banking”.

- Choose the choice for “Forgot password.”

- Enter login ID and account quantity.

- Click on on “Submit”.

- Now, present your E-mail ID and captcha code.

- Click on “Proceed” and enter the OTP acquired on the registered cell quantity.

- Set a brand new password and make sure it.

- Click on on the “Submit” button.

- Your new password is generated and lively to make use of.

Learn how to Fund Switch utilizing IOB Web Banking?

IOB (Indian Abroad Financial institution) web banking permits prospects to switch funds from one account to a different with just a few clicks on their cell screens. Listed below are the steps to observe:

- Login to the IOB on-line web banking account utilizing your ID and Password.

- Go to “Cost” and click on the “Fund Switch” choice.

- Right here, you will notice many choices for fund switch, similar to “Switch inside IOB accounts”, “Switch to self”, and “Switch to different financial institution accounts”.

- Select the specified choice.

- Fill within the particulars within the required fields, such because the account variety of the beneficiary, quantity, IFSC code, and so on.

- Now, click on on the “Switch” choice.

- Enter the OTP you acquired in your registered cell quantity.

- Congratulations! Funds are transferred efficiently, and you’ll obtain the affirmation message in your cell.

Additionally learn: AirtelTez Login Portal, Airtel Cost Financial institution Retailer Login

Learn how to Pay Credit score Card Payments Utilizing IOB Web Banking?

Now, paying the bank card invoice is straightforward utilizing web banking. Comply with the information under:

- Login to the IOB on-line web banking portal.

- Choose “IOB Playing cards”.

- Select “IOB bank cards”.

- Click on “Register card.”

- Enter your bank card particulars and click on on “Affirm”.

Watch for the affirmation message on your IOB bank card registration. When you obtain the affirmation, you may pay the invoice by following the steps under:

- Login to IOB netbanking

- Go to IOB card, choose IOB bank card, and click on on “Make Cost”.

- Choose the account.

- Enter the quantity you want to pay and click on on “proceed”. Your fee is made.

Options of IOB Web Banking

The IOB financial institution provides numerous superb options and companies below Web banking. Let’s take a look at options of IOB banking:

1. Account particulars

IOB web banking permits prospects to test their account steadiness, transaction historical past, and statements utilizing their cell and lively web connection.

2. Fund switch

You possibly can switch funds out of your account to a different utilizing IOB web banking. It additionally lets you conduct interbank transfers and ship the quantity to the opposite IOB buyer. It’s also possible to switch cash immediately utilizing IMPS, NEFT, and RTGS on IOB web banking.

3. Invoice Funds

It’s simple to pay utility payments similar to electrical energy payments, cell recharges, and so on, utilizing the IOB web banking portal.

4. On-line purchasing

Secure and safe on-line purchasing may be performed by utilizing IOB banking as a result of it provides a safe fee gateway for patrons who love to buy on-line. You may make funds to numerous e-commerce platforms.

5. Mounted administration (FD)

Clients can begin a brand new FD account, renew current and test the FD particulars utilizing IOB web banking. It’s also possible to calculate the Curiosity that the financial institution is providing to you in your FD utilizing the FD calculator.

6. Loans

It’s simpler for patrons to test their mortgage standing, excellent funds, and different info on the IOB web banking portal.

7. Funding

IOB web banking lets you put money into numerous merchandise similar to Mutual funds, Authorities saving schemes, and so on.

IOB Buyer Care Quantity

For those who face any points in the course of the registration or login course of, you may contact the client care of the Indian abroad financial institution. The numbers are talked about under:

1800 890 4445

1800 425 4445

Conclusion

IOB web banking is the most suitable choice for these prospects who’re too busy to go to the financial institution and are tech-savvy. The Indian abroad financial institution provides numerous companies to the client below web banking, simplifying the baking for the purchasers. They will shortly pay payments, entry accounts, test balances, get transaction historical past, and so on. whereas sitting on the dwelling workplace.

IOB Web Banking – FAQs

Learn how to activate an IOB account for on-line banking?

Ans. You possibly can apply at your IOB department; you’ll obtain the e-mail after your account activation. Laos, you may contact 044-28519460 / 28889350 for the activation course of.

What may be issued if I’m unable to entry the IOB Netbanking?

Ans. Firstly, test whether or not your web connection is working tremendous or not. Secondly, LAN or ISP is linked to the web. If the difficulty remains to be unsolved, contact buyer care.

Does the IOB cost for utilizing web baking?

Ans. No, there isn’t a cost for utilizing the IOB web banking companies. Nevertheless, you have to undergo all the principles and rules of the financial institution earlier than reaching any conclusion.

Is IOB Netbanking accessible on cell?

Ans. Sure, you need to use IOB web banking in your cell. Obtain the appliance in your smartphone through the Play Retailer. Login utilizing your ID and Password. You should use it wherever, anytime.

Who’s eligible for IOB web banking registration?

Ans. Anybody having a financial savings or present account in an Indian abroad financial institution can use IOB web banking. People, proprietary companies, partnership companies, restricted firms, societies, organizations, trusts, and so on., holding a checking account in an Indian abroad financial institution are eligible to make use of IOB Netbanking.